March 7, 2025

When a Founder Turns Down VC Money: The $50K Rejection That Shocked the Room

"Jesse, I absolutely hate to say this, especially on YouTube, but we've left the 50k checks on the table. So we don't allow any investments under 100k."

With these words, Mike Burton, founder of smart bike lock company Lockstop, did something rare in the startup world – he turned down money from a willing investor. Not just any investor, but Jesse Middleton of Flybridge Capital, during his appearance on The Pitch podcast.

The Setup

Lockstop isn't your typical bike lock company.

They've built a smart lock that attaches to existing bike racks, turning them into data-rich mobility hubs. Cities pay $750 per device upfront, plus ongoing revenue from data monetization. With two pilot cities already signed and more in the pipeline, Burton came to The Pitch seeking $1.5 million in funding.

During the pitch, Jesse Middleton offered to invest $50,000 to "kick things off." For most early-stage founders, especially those seeking their first institutional round, this would be a welcome commitment. It could open doors, build relationships, and create momentum for the larger raise.

But Burton said no.

Why Say No to $50k?

Burton's decision wasn't made in the heat of the moment. Lockstop had already established a clear policy: no checks under $100,000. Even when faced with an investor from a prestigious firm, on camera, Burton stuck to his guns.

"I love that you drew that hard line. That was awesome," said investor Paige Finn Doherty after the exchange.

The move demonstrated something crucial about Burton's approach to building his company – clear standards and unwavering execution, even under pressure.

But wait... was it actually a good strategy to turn down a $50k offer from a VC?

The Risk-Reward Calculation

The decision wasn't without potential downsides. As Jesse later pointed out, "There are going to be some really smart people who could be really helpful, who would come in at this stage with 25k or 50k checks."

These smaller investors often bring more than money:

-

Industry connections

-

Operating experience

-

Future funding access

-

Strategic introductions

By setting a $100k minimum, Lockstop might be cutting itself off from valuable resources. But Burton seemed to believe the tradeoff was worth it. He was hoping to convince Jesse to write a much larger check and potentially lead his $1.5M seed round.

The Aftermath

In a follow-up diligence call a few weeks later, Jesse remained interested... but way more cautious: "I'd like to find a way to support you along the way and stay close to this and potentially get to leading a round."

In VC-speak, "stay close to this" actually means "I'm out for now."

Did Burton's hard stance cost him a potential lead investor? Or did it reinforce his position as a founder who knows his worth?

Only time will tell.

...

Check out the episode and let us know what you think in the comments on YouTube!

When The Perfect Pitch Goes Sideways

When Anastasia Trofimova walked into The Pitch Room she had everything going for her...

Anastasia had the VCs wrapped around her finger. Three offers, from three VCs. Totaling over $1 million.

And yet... she walked away with nothing in the e…

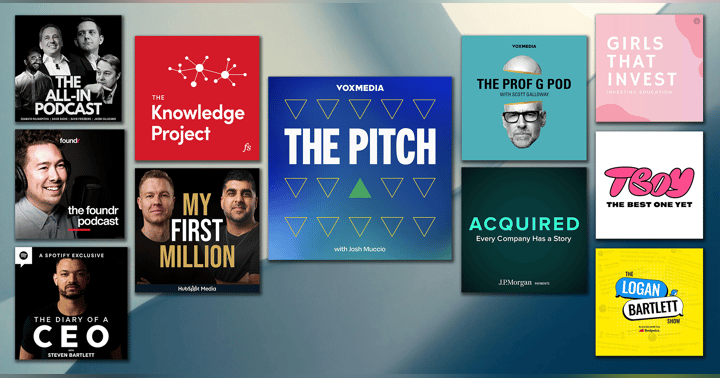

What are the best business podcasts in 2025?

Welcome to 2025, where business podcasting has evolved into must-watch TV. YouTube has dethroned traditional podcast platforms, transforming the medium into a visual-first experience. The podcasts that made this list aren't just keeping up – t…