The Ultimate Guide to Creating Your Pre-Seed Pitch Deck

Building a startup is a thrilling adventure: you've got the passion, the ideas, and are geared up to make your mark on the world. The challenge? Lighting that same fire in others and getting them just as excited about your brainchild.

As an entrepreneur, especially as a first-time founder, crafting your pre-seed pitch deck can be an intimidating process. A pitch deck is your first opportunity to begin a conversation with investors. Do it right, and your deck will open doors to the best investors and partners for your business.

But when it comes to actually presenting your vision to potential investors, you need to clearly and concisely portray your startup's value to investors. It's a tall order, but not an impossible one, as you’re about to learn from our comprehensive guide.

What’s a Pitch Deck?

A pitch deck is a brief presentation with visual elements that you use to provide a quick overview of your business plan to potential investors. A teaser, if you will.

What Does a Good Pitch Deck Include?

Here are the most important things you need to incorporate into your pitch deck:

- The problem your business aims to solve

- The solution it offers

- The market size and opportunity

- The business model and revenue streams

- Competition & competitive advantage

- Current traction or achievements and future milestones

- Financials & projections

- The team behind the venture

- What you need from the investors

You see, a pitch deck is a condensed, visual version of your business plan to help you catch the investors' attention and hopefully convince them to fund your venture. Therefore, it must pack a punch while being concise, persuasive, and engaging.

The Key Elements of a Successful Pitch Deck

We are, by nature, storytelling creatures — our minds constantly yearn to structure information into coherent, engaging narratives. Since we're basically hardwired to love a good story, this practice also happens to be the best way to convince and persuade people — the same reason why no one ever started a religion using a bar graph.

The best pitch decks, much like the best sermons, tell a compelling story, carry a strong narrative, and keep the audience engaged. Here’s a checklist for you to keep in mind when telling your story to potential investors.

1. Identify the Problem

The first thing you need to do is to draw the board into the narrative by presenting a real problem that your startup aims to solve. Make it substantial, highlight the real burden of this problem to the industry or society (depending on your target consumer group), and be relatable to engage your audience. In short, clearly define the problem your startup wants to solve.

2. Introduce Your Solution

Next up, introduce your unique solution. Convey how your startup plans to tackle the problem head-on in no uncertain terms. A good solution is not only innovative but also practically actionable. Be clear, be bold, but above all, be compelling.

Having your audience believe in your solution is the most important part. Once you achieve that, you've got a safety net — even if things go south afterward, you can still get suggestions to improve your plan and put it into action.

3. Business Model

Now that your audience understands the problem and your solution, it's time to reveal how your startup will operate and generate revenue.

How is your business going to make money? Is it through advertisements, subscriptions, or direct sales? Are there franchising or partnerships involved? Is it an online business or a brick-and-mortar store?

Your revenue streams can be more than one, so make sure you highlight them all. It’s vital to make your potential investors understand how your startup will turn a profit.

4. Market Opportunity

Your startup doesn't exist in a vacuum. It's part of a crowded market jammed with challenges and opportunities alike. Understanding these challenges and opportunities doesn’t solely come with instincts — you need to do your homework.

You should paint a picture of the market landscape. What’s its size? What’s the growth potential? What are the key trends? How big is the potential market share for your service or product?

Remember that you’re demonstrating the potential profitability of your solution and its relevance to the target market.

5. Competition & Competitive Advantage

As we’ve just talked about, it's a crowded market out there. And your investors will want to know two things:

- Who are you up against?

- Why are you different?

First off, outline your main competitors and showcase your unique selling proposition (USP). A USP is the one thing that makes your business better than the competition. This can be anything — a patented technology, exclusive partnerships, a business model in a class of its own, or even better analysis and understanding of customer needs.

Here you need to paint a clear picture of how your startup can assert its presence in the market. It's about showing that you're not just another player in the game but a potential game-changer. Use data, testimonials, or any relevant proof points to bolster your claims — anything to distinguish your venture from the rest.

And remember, highlighting your startup's competitive advantage is not just about identifying what you do differently; it's about ensuring your audience, customers, and investors alike understand why this difference matters.

6. Demonstrate Traction and Future Milestones

Let's talk traction and future milestones. This is your bragging moment. Show off what your startup has accomplished. Have you gained a lot of users? Inked significant partnerships? Gotten some high-profile customers?

Having some of these definitely help, but don’t worry if you’re still in the early stages and haven’t made such achievements. These milestones help you demonstrate market fit, and you can still do that without significant penetration into the market. After all, it’s a pitch deck.

If that’s the case, you need to invest some effort into showing that your product has potential. It can be a prototype you’ve tested if you’re building a product. Or it can be insights from a survey or market research if you’re offering a service. This way, you display tangible proof of feasibility and demand, even without market penetration.

And don't stop at where you've been, either. Point out where you're going. Set up future milestones that show you've got achievable plans.

You see, your pitch deck isn't just some slides thrown together – it's a tale about your startup's mission, its potential, and its journey ahead.

7. Financials & Projections

Numbers can speak volumes, and this is where they get their chance. But to reiterate again, you're not just rattling off numbers here, you're telling a story. A story of forecasts, revenues, expenses, and profitability, with a narrative to bring them all together in a common cause: profitability.

This means you can’t just throw in a bunch of numbers and expect the board to connect the dots. You need to explain the assumptions behind your projections.

For example, what market trends, customer behaviors, or business strategies are behind these estimations? Use this opportunity to support your narrative with numbers.

It's all about building trust and assuring investors that your numbers aren't wild guesses. Being transparent about your financials and projections also shows investors you have a solid understanding of your business and market dynamics, and it assures them you're not just pulling numbers out of thin air but making calculated predictions and well-informed decisions.

8. The Team

And what's a story without some heroes and heroines, right? Here they aren’t armed with superpowers or swords but with skills, passion, and unflinching commitment.

Any seasoned investor can tell you the importance of a well-rounded team to steer the ship. Present your team's background, experience, and qualifications. And don't stop at CV highlights; show the passion and commitment your team brings to the table. Include their key roles, notable achievements, and any unique skill sets that make your team well-suited to tackle the problem at hand and how they complement each other. After all, ideas may kickstart the journey, but it's people who walk the actual line.

9. Ask

Now comes the final act— the ask. This is where you lay out what you're seeking from investors.

Tell them how much funding you need and give a clear breakdown of how you plan to use it, whether it's for product development, marketing, hiring, or scaling operations. Show investors how their money will propel your startup to its next phase and return to them in profit.

Remember, you must show investors that their funding won't just be spent but strategically invested in a promising business opportunity. Remember, investors want to feel they're not just writing a check but becoming part of a compelling entrepreneurial journey. Therefore, make sure to highlight the growth potential of your venture.

Bonus Resources

Now you know how to make your dream pitch deck come true. But even with the information at hand, crafting a flawless pitch deck can be a daunting task, especially for first-timers.

Thankfully, in the digital age, there are numerous tools at your disposal to take your pitch deck from good to great. We've rounded up a list of resources, including presentation aids, example pitch decks, agencies, templates, and AI tools, to help you build a compelling narrative and create a visually stunning presentation.

Presentation Aids

Example Pitch Decks

Airbnb Seed Pitch Deck (Raised $600k in 2009)

Buffer Seed Pitch Deck (Raised $500k in 2011)

Intercom Seed Pitch Deck (Raised $600k in 2012)

Pitch Deck Agencies

Pitch Deck Templates

AI Pitch Deck Tools

Explore these resources and find the ones that best fit your needs. A great pitch deck is not just about the information it contains but also how it's presented. Thus, it’s important to convey your story in the most compelling way possible.

Over and Out!

Armed with the essential elements and a cache of resources, you should be ready to create your killer pitch deck. Now you know it's not about inundating investors with information but about telling a compelling story that shows them your vision, proves its worth, and leaves them eager to learn more.

One last thing to keep in mind when creating your pitch deck is your audience. Know who they are and tailor your narrative to resonate with them. After all, your goal is to turn potential investors into believers in your vision. Don't rush the process. Leverage the wealth of resources available to you, and even if you get rejected, take it as an opportunity to learn and try again.

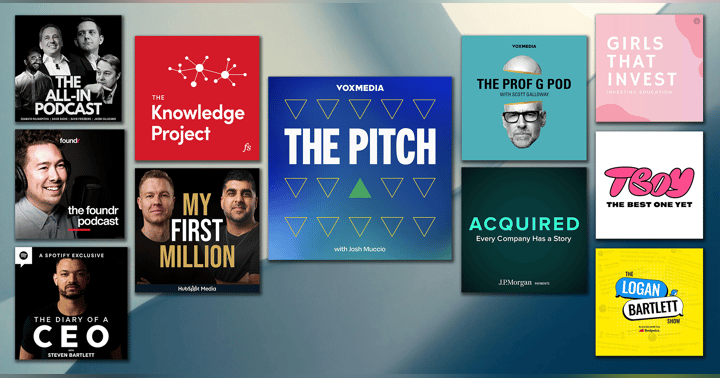

Before you go, if you’d like to add another ace to your arsenal, check out The Pitch Podcast, where you can listen to real-world pitches to investors. It’s kind of like Shark Tank, but instead of fake reality TV drama, you get to hear real pitches to real investors. Founders have raised over $10M on the show so far, and those same founders will tell you that one of the best ways to prepare for your fundraise, is to binge The Pitch.

Because you don’t know what you don’t know about fundraising, but once you’ve listened to over 100 documented pitches to investors, you’ll know.