Leverage Your Retirement Plan: Investing in Startups with a Self-Directed IRA or 401(k)

So, you've been saving diligently for your golden years, making sure your nest egg is comfortably tucked away. But then, the entrepreneurial bug bites, and you find yourself itching to invest in startups, wondering: "Hey, can I dip into my retirement savings to back these ventures?"

The answer is, Yes, you can!—provided you're using a self-directed IRA or 401(k).

Here's a comprehensive look at these financial tools and how you can employ them to back startups.

Understanding 401(k) and IRA

401(k) plans are typically employer-sponsored retirement plans. The money you contribute to your 401(k) comes directly out of your paycheck before taxes are taken out. This means you’re investing pre-tax dollars, thus reducing your taxable income for the year.

However, these contributions, along with any investment earnings, will be subject to taxes when you start withdrawing money in retirement. To compensate for that future tax deduction, many employers also offer a matching contribution up to a certain percentage, which can significantly boost your retirement savings.

On the other hand, an Individual Retirement Account (IRA), as the name suggests, is an account you open on your own and manage independently. Unlike the 401(k), your contributions to a traditional IRA may be fully or partially deductible, depending on your circumstances. What's more, the money you invest grows tax-deferred until you start making withdrawals in retirement.

Shaping Your Retirement Account

Traditional IRAs and 401(k)s tend to limit you to standard investments like stocks, bonds, and mutual funds. But if you want to venture beyond the beaten track and explore alternative asset classes like startups, real estate, crypto, or even art, you need to shift gears and opt for a self-directed IRA or 401(k).

Each of these retirement accounts can be converted into self-directed versions: self-directed 401(k) or self-directed IRA. The self-directed retirement accounts give you the freedom to invest in a wider range of assets, including startups.

Self-Directed Retirement Accounts

To have a self-directed retirement account, you need a custodian to ensure your assets are secure and all transactions comply with IRS regulations. These regulatory parties are usually specialized financial institutions.

However, the custodian merely handles the administrative aspects and does not extend their duties to evaluating the quality or legitimacy of the investments. In this setup, you, as the investor, are responsible for making sound investment decisions.

Alternative investments, such as startups, come with their own set of challenges as they're less regulated than traditional investment avenues. Before you invest your hard-earned savings in such ventures, it's crucial that you conduct thorough research and understand the risks involved.

Startups, though potentially rewarding, can also lead to losses due to factors like market dynamics, competition, and the effectiveness of the management team.

The Difference Between Self-Directed IRA and Solo 401(k)

The self-directed IRA and the Solo 401(k) are distinct retirement investing tools tailored to different needs and circumstances. Let’s talk about their eligibility requirements, contribution limits, investment flexibility, and tax advantages so that you can plot the best course for your retirement plan.

A self-directed IRA is an option open to all who earn an income, whether you're an entrepreneur or an employee. The Solo 401(k), on the other hand, is built specifically for the self-employed and small business owners without full-time employees, except possibly their spouses.

A solo 401(k) account allows for higher contribution limits compared to a self-directed IRA, letting you accumulate capital more quickly.

Both self-directed IRA and Solo 401(k) plans provide flexibility in terms of investment options. You can invest in a wide variety of assets, such as real estate, private placements, promissory notes, and of course, startup companies.

A unique feature of Solo 401(k) is that it allows personal loans (from your retirement account) up to $50,000 or 50% of the account balance, whichever is lower.

On the tax front, a traditional self-directed IRA offers tax deductions on contributions, with taxes applicable upon withdrawal during retirement. The Roth self-directed IRA, however, imposes taxes on contributions but offers tax-free distributions during retirement. The Solo 401(k) can offer the best of both worlds, as it comes in both traditional and Roth versions. However, any employer's contribution to a Solo 401(k) is always pre-tax.

What to Expect from Your Custodian

A custodian is a specialized financial institution that keeps your or your company’s financial assets safe to minimize the risk of theft or loss and maintain the integrity of the assets held within a self-directed IRA.

However, not all assets are eligible for custody. To determine whether an alternative asset is administratively feasible, your custodian must first determine whether they are eligible. This is called the “pre-custody process”.

Once your custodian makes sure they can fulfill their responsibilities and administrative requirements, they realize the necessary steps to transact the assets to your retirement account, provide record-keeping services, and ensure compliance with IRS regulations.

It's critical to verify that your self-directed IRA custodian is IRS-approved to ensure the security of your assets and the legitimacy of transactions. Check out the IRS’s list of approved non-bank trustees and custodians for these retirement accounts.

On top of that, different custodians support services for different types of assets. When choosing a self-directed IRA custodian, ensure they support the type of startup investments you're interested in. Platforms such as AngelList and Republic have simplified investing procedures, integrating seamlessly with various self-directed IRA providers.

In essence, the custodial process, although seemingly complex, is a necessary measure that safeguards your investments, ensures adherence to IRS regulations, and shields your investment from potential tax liabilities. With the right guidance and an approved custodian, you can smoothly navigate this process and invest in the ventures you’d like to back up.

Plus, despite the intricacies of the pre-custody process, there are several firms that aim to streamline the complexity. These companies offer platforms designed to simplify investing in startups through self-directed retirement accounts.

AltoIRA

Founded in 2018, Alto IRA offers a user-friendly and cost-effective automated process for investing. Their fee structure is simple, with two price tiers, and they provide a checkbook IRA. With their easy-to-use platform, AltoIRA simplifies the process of investing in non-traditional assets like startups, real estate, and cryptocurrencies.

Rocket Dollar

Rocket Dollar aims to democratize retirement investing by allowing individuals to unlock their retirement savings for investment in any asset class allowed by the IRS. Their Gold and Core plans provide different levels of service depending on the individual's investing needs. They also automatically set you up with a checkbook.

Equity Trust

Established in 1984, Equity Trust has over $34 billion in invested assets. They are experienced, with a variety of investment capabilities and a strong customer focus. The company also provides educational resources so you make better decisions for your portfolio. They charge annual administration fees and no transaction fees. While they don't offer checkbook control, they do have a dedicated team to facilitate transactions.

The Entrust Group

This firm provides an excellent online portal for managing investments. They integrate their advisor portal into eMoney Advisor for holistic retirement planning. Their account setup is straightforward, however, they don’t offer a checkbook control and charge administrative and transaction fees.

IRA Financial

Founded in 2010, IRA Financial stands out by offering audit protection, guaranteeing that a certified tax professional will help you communicate with the IRS and draft response letters. They also provide online educational resources and checkbook control. Their account setup process is a bit more complex than the others, but the company backs you up with super reliable customer service.

Each of these companies offers different benefits, and the choice ultimately depends on your financial goals, risk tolerance, and how much control you want over your retirement account. When choosing a service provider, always consider your individual circumstances and consult with a financial advisor or tax professional before making a decision.

Also, while investing in startups using your self-directed retirement account is indeed simple, it's worth noting that many investment opportunities on platforms like AngelList are available only to accredited investors. If you're an unaccredited investor, you can still invest in startups using platforms like Republic or WeFunder with your self-directed retirement account.

Making the Most of Your Retirement Account

Investing in startups with a self-directed retirement account is a great strategy to add a layer of dynamism to your retirement planning. These accounts allow you to diversify your portfolio and possibly achieve high returns — with an inherent element of risk.

However, you can open up a world of alternative investments by understanding the nuances of these accounts, adding a different facet to your retirement savings strategy. But remember to tread this path with caution, armed with in-depth research and perhaps the guidance of financial advisors.

In the investment world, knowledge is power. Arming yourself with the right tools and understanding is important, as making the most of your retirement account involves not just diligent saving but also informed investing. For that, gaining insight into the world of startups can serve you a great deal.

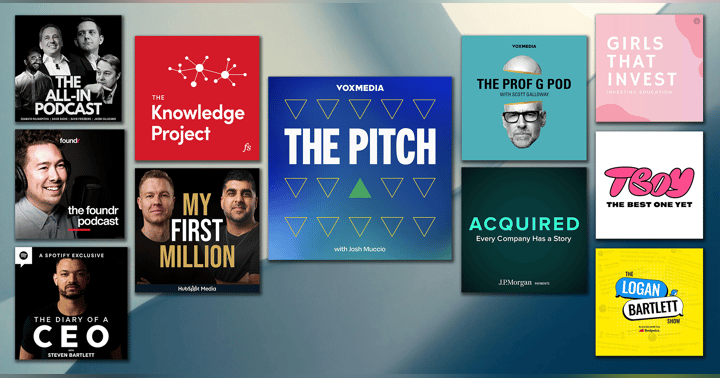

One thing you can do about that is tune into The Pitch Show, where you’ll find enlightening discussions about startups and entrepreneurship. Listen, learn, and leverage your retirement plan to its fullest potential.